Want more like this?

Sign up today to get free articles, webinars, whitepapers, yearly guides and more delivered to your inbox.

How Interest Rates Affect Borrowing Ability

Originally published on November 10, 2023

Updated on February 6th, 2024

In nearly all business endeavors, interest rates matter. But in the real estate sector, interest rates play an especially significant role.

Interest Rate Trends

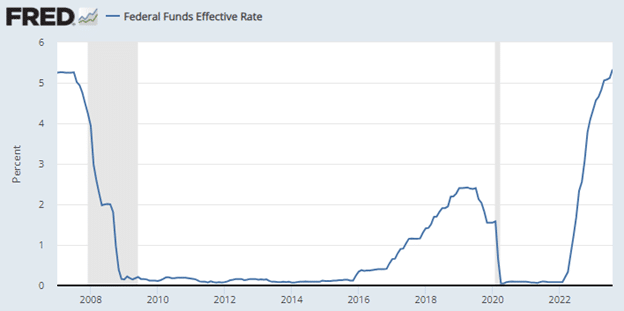

Interest rates were soaring before the 2008 housing crisis, with the Effective Federal Funds Rate (EFFR) peaking at 5.25% in 2007. But once the housing bubble burst, the Federal Reserve dropped the rate to 0%, where it stayed until 2016. The market began to recover over the next few years, and the EFFR rose to a modest 2.25% before a slight regression in 2019.

Then the pandemic hit.

In March of 2020, the Federal Reserve dropped interest rates again, mirroring their response to the 2008 housing crisis. But unlike the prior recession, interest rate recovery following COVID-19 was much swifter. In the six-month period beginning in March 2022, the Federal Reserve raised interest rates five times. By September 2023, the EFFR was up to 5.25%—the highest it had been since 2007.

Why do interest rates matter in real estate?

Interest rates have a significant impact on real estate investment because they directly affect the cost of borrowing.

When interest rates are low, real estate investors effectively get more bang for their buck. With a lower financing cost, it’s more affordable to take out loans to purchase new properties or renovate existing ones. This can make it easier to find a willing buyer if you’re looking to sell.

But it’s not just the cost of borrowing that matters. Interest rates also affect real estate investors’ financial ratios (and therefore their standing with banking institutions).

Debt Service Coverage Ratio

A business’s debt service coverage ratio (DSCR) measures its ability to pay current debt obligations. The formula is as follows:

| DSCR | = | Net Operating Income

|

| Current Debt Obligations |

Although it will vary between institutions, most banks will not accept a DSCR lower than 125%. A DSCR of 125% means that at any given time, a business should be able to cover 125% of its debt payments with the income they bring in.

When interest rates are high, debt obligations are more costly, which will lower a business’s DSCR. If your DSCR dips below that 125% threshold, you may be in violation of your bank’s debt covenants. On an acquisition, the amount of debt you’re able to borrow may be limited by the DSCR, causing a higher amount of equity to be required. This can obviously impact the economics of the investment.

Debt-to-Equity Ratio

There are two ways your real estate business can acquire capital:

- Take out loans from a bank, an investor or another business

- Sell a stake in your business (i.e., issue equity interests to investors)

Purchasing debt and issuing equity are valid and effective ways to raise capital. Most businesses use a combination of both. But there is an ideal ratio between the two. Your business’s debt-to-equity formula is as follows:

| Debt-to-Equity Ratio | = | Liabilities (Debts)

|

| Shareholder’s Equity |

The ideal debt-to-equity ratio varies from industry to industry. In real estate, however, most experts consider a ratio of less than 2.33 ideal. This is when your business acquires its capital using 70% (or less) debt. This is, of course, just a rule of thumb. You must consider a multitude of factors (risk, returns, capital availability, etc.) when developing strategy regarding your fund’s capital structure.

When interest rates are higher, you need to carry less debt—which will lower your debt-to-equity ratio. Your real estate fund needs to balance risk vs. returns. Leverage creates higher returns for equity as long as the overall return on the asset is higher than your borrowing cost. Lower debt can cause lower returns, because there’s more equity to consider. Additionally, because debt interest payments are deductible, equity is often considered more costly.

What can you do when interest rates are this high?

It will likely be many years before interest rates get as low as they were in the 2010s. With the cost of debt much higher than it has been in the recent past, it’s possible you’ll need to change how you manage your real estate business if you want to remain successful.

That said, you’ve got plenty of ways to optimize your business’s performance, even with high interest rates. Look at every aspect of your properties, including:

- The types and quality of properties you’re investing in

- The geographic area of your investments

- The length of your mortgages

- The length of your planned investment in any one property

- Improving your financial projections when certain inputs are unknown

- How to have better communication with investors

- Whether recapitalization makes sense for your business

- How to negotiate different terms with lenders

- Whether you should focus on redevelopment

- Whether you should consider foreclosure

- How to divest yourself from losing properties

- How you can rebalance your capital structure

- How you can leverage existing assets on new purchases

The techniques our real estate advisors suggest will be unique to your business, your interests and your risk preferences. Reach out to our James More real estate team to discuss these possibilities and see how we can help.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like