Key Things to Know About Social Security

Originally published on January 10, 2019

Updated on November 14th, 2024

Social Security is straightforward, right? No, not at all! There are many things to consider before taking benefits. We generally recommend that a married couple delay benefits for the higher earner, if practical, to maximize that higher benefit. At the first death, the lower benefit goes away and the survivor will receive the higher benefit of the two. Losing one benefit is already a reduction in income for the survivor so maximizing the higher benefit can help mitigate that income loss. Please read on for more important information…

How are benefits determined?

“To be eligible for Social Security, you must earn at least 40 ‘credits.’ Up to four credits can be earned annually by meeting the minimum earnings threshold in a given calendar year. If your earnings meet the threshold to earn four credits in one year, you only need to work ten years to be entitled to Social Security benefits. However, the amount you are due in retirement is calculated based on the 35 years in which you earned the most money. If you worked fewer than 35 years, the zero-income years are factored into your benefit calculation, so it benefits you to work as many years as you can, even on a part-time basis.”1 If your earnings are going up, it may be a good idea to keep working so you can replace lower-earning years with your new higher earnings and increase your benefit.

What is your full retirement age?

Full retirement age (FRA) is the key to your benefits. Everything is calculated based on the benefit due you at your FRA, which is also called your primary insurance amount (PIA). Taking Social Security before full retirement age means your benefit will be reduced; taking it later gives you a benefit increase.

Full retirement age for Social Security depends on your year of birth. For those born between 1943 and 1954, full retirement age is 66. If you were born between 1955 and 1959, your FRA goes up by two months for each birth year (e.g. born in 1955, FRA is age 66 and two months; born in 1959, FRA is age 66 and 10 months). For those born in 1960 and later, your full retirement age is 67. Your Social Security statement will indicate your full retirement age, or you can find it online.

Should you take benefits early?

It is important to understand the costs of taking benefits early, so you can make an informed decision. “More people claim at 62, when early Social Security benefits first become available to workers, than at any other age.” 2 A lot of Americans may not be able to find another job or simply can’t work beyond age 62, so taking benefits early is really their only choice. In my experience, for those who do have a choice, many want start benefits as early as possible based on one or more of the common rationales: a) I won’t live to a ripe old age, b) Social Security is “going broke”, c) I can invest my Social Security benefit and make a killing, or d) I can live off my benefit and keep my portfolio invested.

Suffice it to say that you are more likely to outlive your mortality expectation than not, Social Security isn’t “going broke,” though some action needs to be taken to provide full benefits for future generations, and you may not be the investing guru you aspire to be. Determining whether you are better off taking the benefit early requires careful analysis of all the following:

- Income sources including pension and annuity income

- Living expenses

- Income taxes

- Inflation expectations

- Investment portfolio asset allocation

- Projected amount of required minimum distributions (RMDs) from qualified retirement plans

- Realistic life expectancy assumptions

For those in their 60s who need to make this decision, we highly recommend working with your HKFS financial planning consultant. This type of comprehensive analysis is something we routinely provide though our GPS planning program for clients.

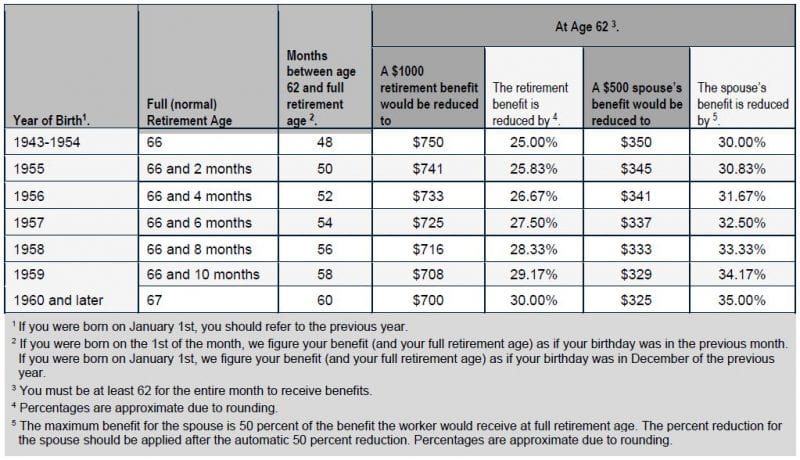

Below is an excerpt from a table on the ssa.gov website that shows the impact of taking benefits early, and on your spouse if he or she takes the spousal benefit early (a full table is available online).

Note that a person born in 1954 who took the benefit at age 62 incurred a 25% reduction. A person born in 1960 or later taking the benefit at age 62 gets a 30% reduction. Why is that? In the early 1980s, changes were made by Congress to keep future program costs down. One of those changes was to increase the retirement age to 67. “Future retirees have to either choose to wait longer to receive their full benefit, thus reducing the number of years they’re collecting a benefit or accept a steeper reduction to their payout if they claim early, hurting their aggregate payout over the long run. No matter how you look at it, aggregate benefits paid are reduced for future retirees.”

The spousal benefit shown in the chart is for your spouse taking benefits early. Note that your spouse cannot take a spousal benefit until you file for your own benefits. The chart shows that the percentage reduction for taking the spousal benefit early is greater than for you. The rationale here is that when you die, your spouse will take over your benefit and receive the higher amount. The cost of that is factored in to the benefit reduction.

A common way to make the decision of when to start benefits is to look at a break-even analysis. This shows you the age at which delaying benefits until age 70 becomes a better strategy than taking benefits at age 62. Most of the break-even points I have seen are around age 81. If one or both of you lives beyond age 81, delaying benefits to age 70 will be the better way to go purely from the perspective of maximizing lifetime benefits.

Keep in mind that Social Security is designed to provide the same overall payout to you whether you take it early or late based on your actuarial life expectancy. If everyone lived just to their actuarial life expectancy, it wouldn’t really matter when you started taking your benefits. Your lifetime benefit payout would be about the same. That makes the decision more about when you will need the benefits most for your own personal cashflow needs, in your 60s or in your 70s and 80s?

Should you delay benefits?

“For many retirees, that can be a $200,000+ decision. That’s the amount that top earners can expect to receive in excess of their normal benefits should they delay them until age 70. Each year you delay your benefits past increases your benefit payout by 8%. Waiting until age 70 to start benefits results in a 32% increase in your monthly benefit for life.

Where else can you earn a guaranteed 8% return on your money?3 That question has been particularly relevant in the low interest rate environment we have been in since about 2008. Those with excess cash earning less than 1% may find that using that cash for living expenses may be a better option than drawing Social Security at FRA and foregoing the 8% annual increases. As stated previously, the longer one of you lives, the better off that person will be for having the higher earner delay taking benefits.

Anything else you should know?

- The spousal benefit reaches its maximum at your spouse’s full retirement age. It does not go up after that.

- If you were born on or before January 1, 1954, you may be eligible for restricted spousal benefits. That means once you have reached your FRA, you can file to take your spousal benefit based on your spouse’s earnings record, and then switch to your own benefit as late as age 70.

- A widow or widower can start taking a survivor benefit at age 60, but the benefit will be reduced because it was taken before full retirement age.

- If you are divorced, you can take a spousal benefit based on your ex-spouse’s earning record if you were married 10 years or more, are at least age 62 and you have not remarried. If you do remarry and you get divorced or your new spouse dies, you can apply for spousal benefits based on your first spouse’s record.

- If you start benefits and change your mind, you can withdraw your claim if it has been less than 12 months since you began taking benefits and you pay back all the benefits you received.

- “If you start benefits before FRA and are still working, your benefits will be reduced. you will forfeit $1 in benefits for every $2 you make over the earnings limit, which in 2018 is $17,040. Once you are past full retirement age, you can make as much money as you want with no impact on benefits. At full retirement age, the Social Security Administration will refigure your benefits going forward to take into account benefits lost to the test. For example, if you claim benefits at 62 and over the next four years lose one full year of benefits to the earnings test, at a full retirement age of 66 your benefits will be recomputed — and increased — as if you had taken benefits three years early, instead of four. That basically means the lifetime reduction in benefits would be 20% rather than 25%.4

- Social Security benefits are taxable based on your income.

- The “file and suspend” strategy was eliminated in early 2016 to reduce program expenses as part of a 2015 budget bill.

When to Take Benefits: A Summary from Charles Schwab

There are several factors to think about. Consider taking benefits earlier if:

- You are no longer working and can’t make ends meet without your benefits.

- You are in poor health and don’t expect to make it to average life expectancy.

- You are the lower-earning and your higher-earning spouse can wait to file for a higher benefit.

Consider waiting to take benefits if:

- You are still working and make enough to impact the taxability of your benefits. (At least wait until your normal retirement age so benefits aren’t further reduced due to earnings.)

- You are in good health and expect to exceed average life expectancy.

- You are the higher-earning spouse and want to be sure your surviving spouse receives the highest possible benefit.

Please contact your James Moore advisor or HKFS planning consultant if you have questions or if you would like a complete analysis and review of your social security options. You can also visit the Social Security website for more information and retirement benefit calculators.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Investment advisory services are offered through Avantax Planning PartnersSM. Commission-based securities products are offered through Avantax Investment ServicesSM, Member FINRA, SIPC. Insurance services offered through licensed agents of Avantax Planning Partners. 3200 Olympus Blvd., Suite 100, Dallas, TX 75019. The Avantax entities are independent of and unrelated to James Moore & Company. Although Avantax does not provide or supervise tax or accounting services, our Financial Professionals may offer these services through their independent outside business. Not all Financial Professionals are licensed to offer all products or services. Financial planning and investment advisory services require separate licenses.

1 “What You Need to Know About Social Security,” Catherine Schnaubelt, Forbes, May 9,2018;

https://www.forbes.com/sites/catherineschnaubelt/2018/05/09/what-you-need-to-know-about-social-security/#3cbe94f37dda

2 “What Raising Social Security’s Retirement Age Really Means,” Dan Caplinger, The Motley Fool, January 13, 2018;

https://www.fool.com/retirement/2018/01/13/what-raising-social-securitys-retirement-age-reall.aspx

3 “Why You Should Delay Social Security Benefits,” Craig Slayen, Kiplinger, January 4, 2017;

https://www.kiplinger.com/article/retirement/T051-C032-S014-why-you-should-delay-social-security-benefits.html

4 “10 Things You Must Know About Social Security,” Rachel L. Sheedy, Kiplinger, 2018;

https://www.kiplinger.com/slideshow/retirement/T051-S001-what-you-must-know-about-social-security/index.html“

Other Posts You Might Like