Individual Shared Responsibility Provision & Filing Requirements

Originally published on February 13, 2015

Updated on February 13th, 2024

The IRS released the new Publication 5187, Health Care Law: What’s New for Individuals and Families, which covers some of the tax provisions of the Affordable Care Act (ACA) and explains how taxpayers satisfy the Individual Shared Responsibility provisions (ISR) by enrolling in minimum essential coverage, qualifying for an exemption, or making a shared responsibility payment.

What is the Individual Shared Responsibility (ISR) Provision?

The ISR provision of the ACA requires you to do one of the following for each month of the year:

- Have qualifying health care coverage (minimum essential coverage), or

- Qualify for an exemption from coverage, or

- Make an individual shared responsibility payment when filing your federal income tax return (penalty for not carrying insurance).

*Note that a taxpayer will need to make an ISR payment when filing federal income tax returns if anyone in their household does not have minimum essential coverage and does not qualify for a coverage exemption.

Who do the ISR rules Concern?

All U.S. citizens are subject to the provisions, as are all non-U.S. citizens who qualify as resident aliens for federal income tax purposes. Foreign nationals living in the U.S. who do not become resident aliens for tax purposes are exempt from the ISR provision, even if they file a U.S. income tax return.

Taxpayers are liable for him or herself and for any individual the taxpayer could claim as a dependent for federal income tax purposes. In other words, all children must have minimum essential health coverage or qualify for coverage exemption for each month in the year. If not, the primary taxpayer who claims the child as a dependent for tax purposes will owe an ISR payment for the child.

Minimum Essential Coverage

Minimum Essential Coverage is a health care plan or an arrangement identified as minimum essential coverage. This includes:

- Government-sponsored programs (Medicare Part A, Medicare Advantage, most Medicaid programs)

- Employer-sponsored coverage under a group health plan, including self-insured plans

- Individual market coverage (a qualified health plan purchased through the Marketplace or individual health coverage purchased directly from an insurance company)

- Grandfathered health plans (plans that existed before the ACA and have not changed since the ACA passage)

- Other plans or programs that the Department of Health and Human Services recognizes as minimum essential coverage for the purposes of the ACA

How to Report Minimum Essential Coverage

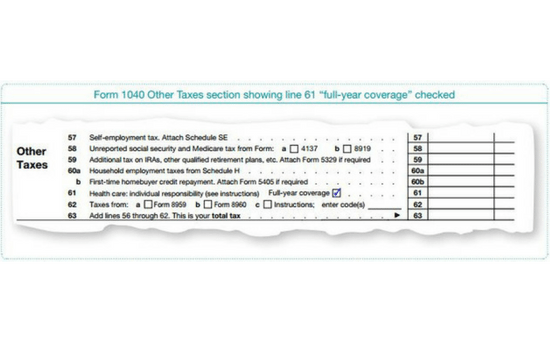

If your entire household had minimum essential coverage for each month of the year then you must check “Full-year coverage” on your Form 1040, 1040A, or 1040EZ. No further action is required.

Health Coverage Exemptions list:

Following is an abbreviated list of health coverage exemptions. Read the IRS chart for a complete list of exemptions.

- Unaffordable Coverage – Amount taxpayer would have paid for the lowest cost employer-sponsored coverage available, or for coverage through the Marketplace that is more than eight percent of taxpayer’s household income for 2014.

- Short Coverage Gap – Without coverage for fewer than three consecutive months during 2014.

- Household income below the return filing threshold – Household income is below the minimum threshold for filing a tax return.

- Members of a health care sharing ministry – A tax-exempt organization whose members share a common set of ethical or religious beliefs and have shared medical expenses in accordance with those beliefs continuously since at least December 31, 1999.

- Incarceration – Taxpayer was in a jail, prison or similar penal institution or correctional facility after the disposition of charges.

Taxpayers claim coverage exemptions on Form 8965, Health Coverage Exemptions, and attach it to Form 1040, Form 1040A and Form 1040EZ. Visit the IRS website for additional filing information.

Taxpayers are encouraged to contact their CPA if they think they need to report and calculate the following: ISR payments; Exemptions from health coverage; or minimum essential coverage of entire tax household for each month of the year.

What is the Individual Shared Responsibility Payment?

If anyone is your household does not have minimum essential coverage, and does not qualify for a coverage exemption, you will need to make an individual shared responsibility payment (SRP) when filing your federal income tax return.

For 2014, the annual SRP amount is the greater of one percent of your household income or a flat dollar amount ($95/adult and $47.50/child, maximum $285/family), but is capped at the national average premium for a bronze level qualified health plan available through the Marketplace that would cover everyone in the tax household who does not have coverage and does not qualify for a coverage exemption. For 2014, the annual national average premium for a bronze level health plan available through the Marketplace is $2,448 per individual ($204 per month per individual), but $12,240 for a family with five or more members ($1,020 per month for a family with five or more members).

Taxpayers owe 1/12th of the annual SRP for each month they or their dependent(s) do not have coverage and do not qualify for a coverage exemption.

Following is an example provided by the IRS in their Publication 5187.

Single individual with $40,000 income:

Jim, an unmarried adult with no dependents, did not have minimum essential coverage for any month during 2014 and does not qualify for a coverage exemption. For 2014, Jim’s household income was $40,000 and his filing threshold is $10,150.

- To determine his payment using the income formula, subtract $10,150 (filing threshold) from $40,000 (2014 household income). The result is $29,850. One percent of $29,850 equals $298.50.

- Jim’s flat dollar amount is $95.

Because $298.50 is greater than $95 (and is less than the national average premium for bronze level coverage for 2014), Jim’s shared responsibility payment for 2014 is $298.50, or $24.87 for each month he is uninsured (1/12 of $298.50 equals $24.87).

Jim will make his shared responsibility payment for the months he was uninsured when he files his 2014 income tax return.

Do you have questions regarding the Affordable Care Act and how it impacts you and your family? Contact your CPA for more information.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like