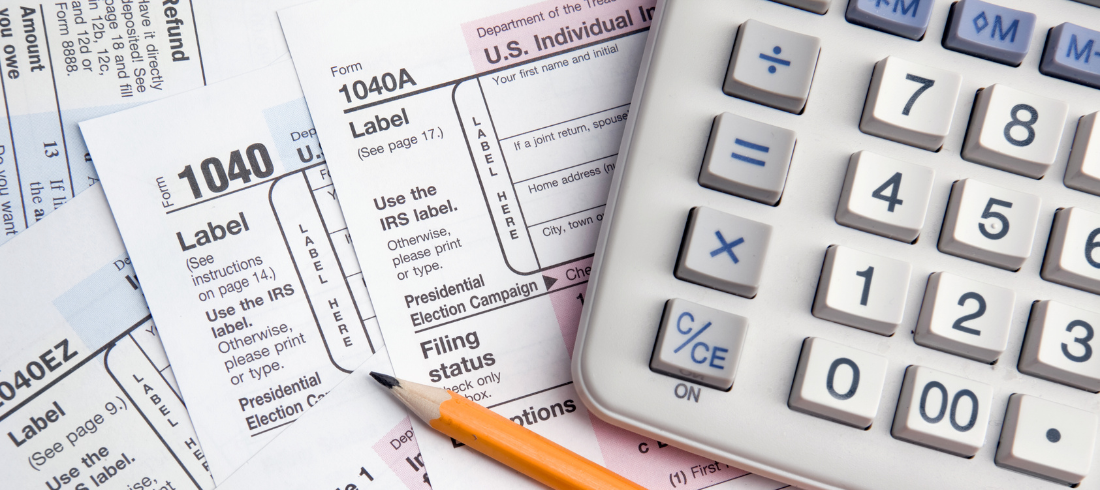

The 2025-2026 Web Tax Guide is Here!

From tax planning basics to strategies for executive compensation and charitable giving, we’ve got everything you need to get the most out of your 2025 return.

Business Tax Services

Your business might be a passion for you, but let’s face it – you started it to make money. And while gaining more customers might be your first method to increase your profits, there’s also another way: your company tax strategy.

From deductions and credits on your business tax return to selecting the right entity structure, there are many ways for you to save money on your tax obligations. You can also avoid costly penalties by staying in compliance with laws and regulations tied to payroll, expenditures and more. Whether you’re just starting out or have a mature, established business, there are strategies you can use to improve your bottom line.

Let us help you find opportunities.

The IRS provides thousands of tools to help reduce your company tax burden, and they can get pretty complicated. That’s where we come in.

With James Moore, you have more than a check-the-boxes tax preparation service; you have a partner with the knowledge and experience to make sense of all the options available. We’ve been providing business tax services for over 50 years in a variety of industries, and our experience has taught us that everybody’s situation is different. And as a full-service accounting and consulting firm, we can look beyond basic business tax services to consult you on other areas to help you increase profitability.

There are tax savings opportunities for businesses big and small, and in just about every industry. By getting to know you and your business, we can help you find the ones that work best for you.

Need more information? Check out our library of tax-related articles.

Strategic Charitable Giving: How to Maximize Both Impact and Tax Benefits

We give because we care. Whether it’s supporting a cause, helping a community, or leaving…

Be the First to Hear.

Sign up for our newsletter and have it delivered to your inbox, so you don’t miss a thing.

John VanDuzer, CPA

Partner

John helps a variety of clients to achieve their long-term goals, minimize their tax burden and maximize the value of their business. As a key member of our Real Estate Services team, he has extensive knowledge and experience in the accounting and tax concerns of this industry. The Partner-in-Charge of our Ocala office, John also heads the firm’s Tax Department and leads a team of over 40 professionals in serving the firm’s business and individual tax clients.

John’s expertise spans several areas:

Real Estate Industry

Real estate development

Investments

Property management

Hotel development

Homebuilders

Business Consulting

Succession planning

Purchase and sale transactions

Estate and gift tax planning

Like-kind exchanges

Partnerships

Entity structuring

Special allocations

Tiered partnerships

Profits interests

An active speaker and writer within the community, John regularly addresses topics specific to real estate development gains and losses, tax opportunities, property manager solutions, capitalization policies, and advanced tax implications specific to real estate. He is a member of the Builders Association of North Central Florida and the local chapter of the Urban Land Institute.