Our real estate accountants provide robust services for complex real estate matters

Whether you have large-scale investments, real estate funds or broad commercial/ multi-unit residential projects, you face a myriad of concerns:

- Building and structuring real estate investment funds (and compensating the operator)

- Taking advantage of tax reform benefits like Opportunity Zones

- Complex tax planning strategies and corporate structure

- Transforming real estate to make it as attractive as possible

- Complying with fund accounting, administration, and reporting requirements

- Understanding the current economic forces

- Managing relationships with the professionals who can help your business thrive

- Planning for your exit and retirement

Your real estate needs go beyond the basics — and so do the services we provide.

A Comprehensive Guide to Accounting for Real Estate Funds

Check out our comprehensive resource covering the key aspects of real estate accounting, from financial reporting to tax strategies and overall compliance. Whether you manage a fund or plan to invest yourself, get the knowledge you need to make informed decisions.

Why hire our real estate CPAs?

Our goal is to continually improve the profitability of your real estate activities and ensure smooth transactions. That means we’re constantly working to increase our knowledge and the level of service you receive. It’s a commitment to always be bettering ourselves. To go above and beyond every day. Just like you.

When you partner with us, you’ll work with a team focused on understanding your real estate goals and finding effective strategies to help you achieve them. Count on us for everything from transactional support to timely K1s that keep your investors satisfied (we have a long history of completing tax returns by March 15th—no matter what).

Audit, Consulting & Tax Services From Our Real Estate CPAs

Whether you're navigating complex real estate transactions or seeking to optimize your investment strategies, our team offers comprehensive accounting and advisory services tailored to the real estate industry.

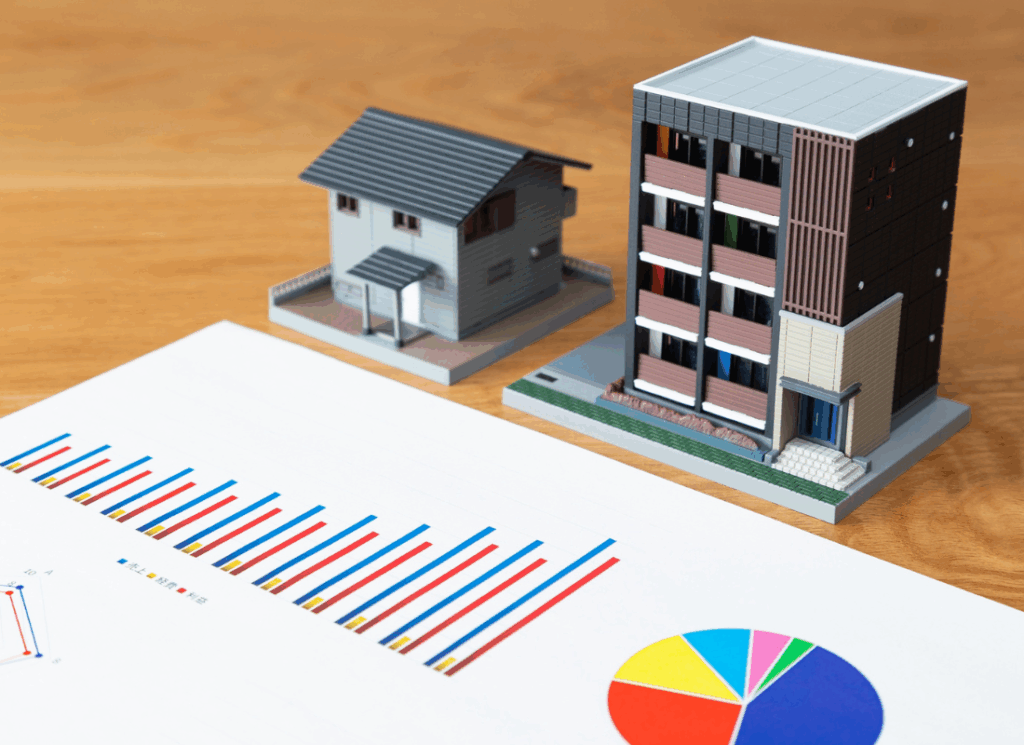

Real Estate Developers

Managing commercial properties or developing multi-unit residential projects presents unique challenges—our team provides specialized accounting and advisory services tailored to real estate developers' needs.

Real Estate Investors

Navigating the intricacies of real estate transactions or optimizing investment strategies requires expertise. Our team delivers comprehensive accounting and advisory services specifically crafted for the real estate industry.

Real Estate Funds

Whether you're launching a new real estate fund or refining the performance of your current investments, our experts are ready to support you with tailored accounting and advisory services to meet your goals.

Measurably Better Real Estate Accounting & Investment Strategies

We help you build success in real estate one property at a time.

Real Estate Accounting Solutions & Services

Managing a real estate fund (or a portfolio of investments) is an increasingly popular option for real estate professionals. Our services are designed to help you make the most of this exciting aspect of property investments, commercial development and financial growth.

Reliable financial reporting is essential for success in real estate. Whether you’re developing a property, managing multiple entities or seeking new financing opportunities, lenders and investors want to see clear, accurate financial statements.

At James Moore, our real estate CPAs provide tailored assurance services that help demonstrate your organization’s financial integrity. From streamlined compilations to full audit reports, we deliver the level of assurance your business and stakeholders require.

Our team’s deep understanding of the real estate industry ensures that your financial reporting aligns with both lender expectations and industry best practices. So you can pursue funding with confidence and maintain transparency across all your ventures.

As your real estate portfolio expands, managing your accounting can quickly become complex, especially with multiple entities, property types and investment structures. From cash flow management to project-level reporting, accurate and timely financials are essential for strategic decision-making.

At James Moore, our real estate outsourced accounting team delivers scalable, technology-driven solutions that keep your books clean, compliant and insightful. We handle everything from daily transactions to advanced financial analysis to allow you to focus on growing your investments.

- General ledger and month-end close management

- Accounts payable and receivable processing

- Bank and credit card reconciliations

- Financial statement preparation and analysis

- Job costing and inventory accounting

- Budgeting and cash flow forecasting

Managing substantial real estate wealth often means balancing multiple entities, assets and generations—all with their own financial goals and tax implications. Our outsourced family office management services provide high-net-worth individuals and families with a cohesive, strategic framework for overseeing all aspects of their wealth.

At James Moore, we unify your real estate holdings, investments and financial operations under one coordinated system. From day-to-day accounting to long-term estate and tax planning, our team helps protect your assets, streamline management and preserve your family’s legacy.

Key Services:

- Centralized financial and investment oversight

- Tax compliance, planning and advisory

- Estate and multi-generational wealth strategy

- Bookkeeping support

- KPI dashboards and financial performance analytics

Real estate tax planning involves more than just meeting filing deadlines. It’s also about uncovering opportunities hidden within complex tax codes and ever-changing regulations. The right strategy can enhance cash flow, minimize liabilities and maximize the long-term value of your investments.

At James Moore, our real estate tax specialists combine deep industry expertise with proactive planning to help you take full advantage of available deductions, credits and incentives. From entity structuring and depreciation strategies to 1031 exchanges and cost segregation studies, we develop tailored solutions designed to strengthen your financial position. We also provide ongoing compliance support to keep your business aligned with federal, state and local tax requirements.

Our services include:

- Strategic tax planning and multi-entity structuring

- Federal, state and local tax compliance

- Cost segregation and depreciation optimization

- 1031 exchange guidance and capital gains planning

- Credits and incentives for energy efficiency and development

In the real estate industry, success is often built over decades by families, partners and close associates working toward a shared vision. But even the most stable businesses face transitions. Whether it’s retirement, a sale or an unexpected change in leadership, having a well-defined plan ensures continuity and preserves the value you’ve worked hard to build.

At James Moore, our real estate CPAs help owners develop comprehensive transition plans that align with both business and personal goals. We consider everything from succession timing and ownership structure to tax implications and family dynamics, ensuring a smooth transfer of leadership and assets.

A written, proactive plan protects your legacy, employees and investors — so your company continues to thrive long after you step away.

Our transition planning services include:

- Succession and ownership transfer planning

- Business valuation and equity analysis

- Buy-sell agreements and exit strategies

- Tax-efficient transition structures

- Family governance and next-generation planning

Building and preserving wealth in real estate requires a thoughtful strategy that balances opportunity with risk. From investment planning to retirement and tax strategies, every decision you make today shapes your financial future.

At James Moore, our real estate-focused CPAs and financial advisors provide comprehensive wealth management solutions designed to grow and protect your assets. We understand the unique financial goals of property owners, investors and developers, and we help you align those goals with long-term, tax-efficient strategies.

Through our partnership with Avantax Financial Services, a trusted national wealth management firm, we deliver integrated guidance that connects your accounting, tax and investment needs under one cohesive plan. Together, we help you make informed decisions with confidence and clarity.

Our services include:

- Retirement planning and income strategies

- Investment and asset management

- Risk management and insurance solutions

- Comprehensive financial planning (Financial GPS)

Real Estate Industry Update

The Real Estate Industry Update is our video series that brings our top real estate CPAs along with some of Florida’s top commercial and residential real estate brokers, agents, bankers, and other experts to discuss what’s happening in the industry. Our videos are released periodically and contain information on real estate hot topics such as tax planning, cost segregation, 1031 exchanges, industry updates and more.

Subscribe to our video series to receive updates when new videos are released.

Cost Segregation Infographic

Increase Cash Flow and Reduce Taxes with a Cost Segregation Study

Cost segregation studies separate real property into depreciable categories, allowing taxpayers to depreciate property over much shorter periods of time. By taking deductions sooner, owners lower their current-year tax liability and free up more capital.

Case Study: Project Accounting for Large-Scale Real Estate Developments

A commercial real estate development company was planning a $300 million mixed-use development to include office, residential, retail, entertainment and hotel space. With such a large and multi-faceted undertaking involving dozens of subcontractors, it’s important to monitor contracts and expenditures closely in order to stick with the budget and make the best use of project funds. The developer needed outsourced accounting and controllership services from a company that could handle the size and complexity of this project, and James Moore was hired for the job.

Among other services, James Moore’s real estate CPAs provided a real-time dashboard from which the developer could see all transactions, expenditures, financial reports, budgets and cash on hand for every aspect of the project. This made the data available as these transactions happened instead of having to wait 60-90 days for the information to come through the usual channels. With the ability to view accurate financial reports and manage contracts in real time, the company was better able to properly manage the financial aspects of what became a very successful project.

Featured Articles on Real Estate Accounting

Be the First to Hear.

Sign up for our newsletter and have it delivered to your inbox, so you don’t miss a thing.

Daniel Roccanti, CPA

Director

Daniel has ten years of experience in tax accounting and consulting. As a director, he leads and supervises a team that provides tax planning, tax preparation, compliance and accounting services to the firm’s clients. Daniel’s focus is on modern innovative solutions to help each client grow and reach their aspirations.

While Daniel works with a wide range of individual and business clients, his expertise is in real estate. In addition to leading the firm’s Real Estate Services team, he is also a real estate investor himself — allowing him to bring his personal experience to the table. Daniel also has a background as an IT analyst, and he uses this knowledge to combine technology and accounting to better help his clients.

Daniel also has expertise in nonprofit tax compliance. He provides tax reporting and consulting for the firm’s nonprofit clients allowing these organizations to help better their communities. He also leads the Tallahassee office’s tax compliance and Form 990 preparation services for nonprofits.

Caleb Brogan, CPA*

Senior Tax Manager

Cheri Swan, CPA

Senior Manager

Christie Renaker

Tax Manager

John VanDuzer, CPA

Partner

Justyna Mueller, CPA

Partner

Kim Hardy, CPA/ABV/CFF, CVA

Director

Kyle Paxton, CPA

Director

Matt Thompson

Senior Manager

Ryan Miller, CPA

Tax Manager

Savana Strickland, CPA

Senior Manager

Sean Sarkissian, CPA

Senior Tax Manager

Stacy Joyner, CPA

Partner

Suzanne Forbes, CPA

Chief Executive Officer

Vittoria “Torri” Heggie, CPA

Tax Manager