Want more like this?

Sign up today to get free articles, webinars, whitepapers, yearly guides and more delivered to your inbox.

HHS Releases Updated Reporting Requirements for PRF Recipients

Originally published on June 30, 2021

Updated on February 6th, 2024

With the ever-changing environment of the COVID pandemic and its effect on healthcare providers, the Department of Health & Human Services (HHS) has once again shared new Provider Relief Fund (PRF) reporting requirements and guidance. The aim is to give healthcare providers more flexibility and clarity when it comes to PRF reporting.

The Department of Health & Human Services (HHS) started issuing guidance on reporting requirements for PRF recipients back in July 2020. Then they released updated requirements in January 2021 in response to the Coronavirus Response and Relief Supplemental Appropriations Act of 2021, along with opening registration for the online reporting portal.

HHS released its new guidance on June 11, 2021. Among the major changes are expanded timeframes for reporting and longer windows for spending PRF payments received after June 30, 2020. The goal is to reduce the administrative burden on smaller healthcare providers and allow them more flexibility in using the funds.

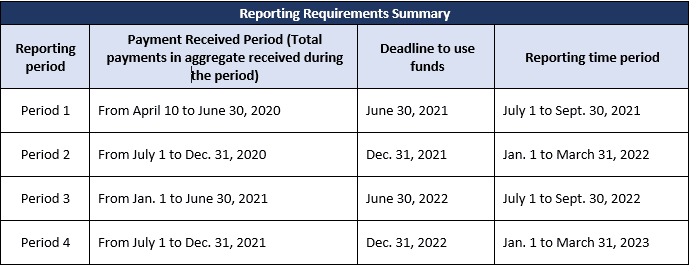

The new requirements only apply to providers who received over $10,000 in total payments during a single payment received period. In addition, the 30-day reporting period is increased to 90 days after the expenditure deadline for each three-month time period. In total, there are four separate reporting periods and time requirements to expend the funds depending on the dates when the relief funds were first received.

Lastly, the PRF reporting portal now allows providers to start supplying the required information for reporting purposes on July 1, 2021 once the PRF reporting portal is operational. Below are the key changes outlined.

Important Changes

- Previously, all payments were required to be spent by June 30, 2021, regardless of when they were received. Now, however, this deadline varies based on the date the payment is or was received (see the table below).

- Reporting requirements apply to each payment received period in which providers took in a total of $10,000 or more (regardless of the number of payments in the period). Previously, reporting was required once the $10,000 threshold was reached from all PRF payments.

- The previous 30-day reporting period has been extended to 90 days.

- Exceptions to the new reporting requirements apply to the Rural Health Clinic COVID-19 Testing Program, the HRSA COVID-19 Uninsured Program and the HRSA COVID-19 Coverage Assistance Fund. The programs do not fall under the new PRF guidance.

The following table summarizes the reporting requirements:

The complete details and revised reporting requirements language replacing the Jan. 15, 2021 requirements can be found at the HHS website.

If you’ve received PRF monies and have questions, please reach out to our healthcare CPAs. We’ve been tracking HHS announcements and other developments regarding PRF to make sure you have the latest information.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like