Changes Ahead: The 2019 Sales Tax Rates are Out!

Originally published on December 19, 2018

Updated on November 14th, 2024

The new year also brings new sales tax rates! The Florida Department of Revenue (FDOR) has released its 2019 tax rates for general sales tax and commercial rent sales tax. So whether you own a business, make purchases or rent property, chances are you’ll be affected.

Here are the changes that will take effect on Jan. 1, 2019.

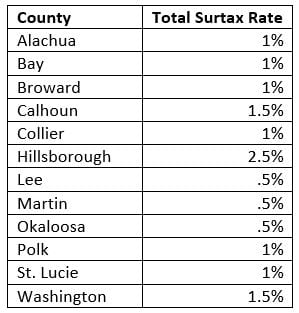

Local Surtaxes

While the statewide sales tax will remain at 6%, 12 Florida counties will see changes in their total tax rate thanks to new, revised, extended or expiring local surtaxes. According to the FDOR, here are the affected counties:

Commercial Rent Sales Tax

Florida’s sales tax on total rent charged for renting, leasing, letting or granting a license to use real property will decrease from 5.8% to 5.7%. Affected properties include commercial office space, retail space, warehouses, self-storage units or mini-warehouses.

It’s important to note that the sales tax rate is based on the time the tenant occupies (or is entitled to occupy) the property, regardless of when the rent is paid. For example, you own a retail storefront and a new tenant signs a lease on December 20, 2018 and pays the first month’s rent upon signing. However, the lease takes effect (and the tenant can move in) on January 1, 2019. That first month’s rent is subject to the new 5.7% tax rate, because that is the rate that will apply when the tenant is entitled to occupy the space.

How do I prepare for the new tax rates?

Individuals simply need to be aware of the new tax rates to ensure they are charged the proper amounts for their purchases.

For business that collect general sales tax, you’re most likely to encounter this issue when filing your sales tax returns. If you use a point-of-sale (POS) system for customer purchases, check with your vendor to see whether you need to manually update your registers to calculate the correct rate for your county. Property owners renting real property need to be aware of the new commercial rent sales tax rate and adjust leases accordingly.

You can find more information about the changes in sales tax rates on the Florida Department of Revenue website. And as always, check with your tax CPA if you have any questions on how to prepare for the new sales tax rates.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like