Operating Measures and GAAP Compliance: The Importance of Consistency and the Future of Nonprofit Reporting Guidelines

Originally published on May 2, 2016

Updated on November 14th, 2024

Nonprofits serve a wide range of people and causes, so it stands to reason that these organizations need flexibility in how they report their finances. But there is also a case to be made for consistency. When nonprofits vary widely in their reporting, it can be difficult for donors, creditors, grantors, and other outside parties to find meaningful information about the financial performance and needs of an organization. And that can hinder contributions, grants or other forms of assistance.

In 1993, the Financial Accounting Standards Board (FASB) established generally accepted accounting principles (GAAP) for nonprofits regarding their financial reporting to help ensure financial comparability between these organizations. However, FASB recently announced that nonprofits are not consistently complying with some of these principles.

In studying the existing guidelines, the FASB Not-for-Profit Advisory Committee (NAC) realized that some areas of reporting could be simplified or otherwise improved. As a result, several changes in GAAP are now being finalized by FASB to help nonprofits more easily and clearly report their financial information.

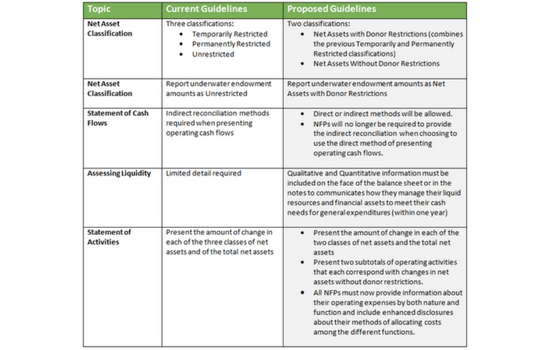

The changes primarily affect information used to understand the liquidity, financial performance and cash flows of an organization. The following table highlights just a few of the changes stemming from these new guidelines. (A complete listing of decisions made to date regarding the changed guidelines can be found on FASB’s website at the link following this article.)

Some existing guidelines will continue to remain in effect, such as the requirement to provide information about the nature and amounts of donor restrictions on net assets. Nonprofits will also still need to report expenses by their functional classification either on the statement of activities or in the notes of the financial statements.

FASB believes that these changes will make reporting less confusing for nonprofit accounting personnel, as well as streamline financial statements to make it easier for outside parties to understand and compare them. Leaders and board members of these nonprofits can also benefit; reports compiled under the new guidelines will help them benchmark their organizations’ financial performance with that of their industry peers. The new guidelines will be in effect for financial statements for fiscal years starting after Dec. 15, 2017.

With more detailed and consistent guidelines, nonprofits will be able to more clearly report their finances – and as a result, better serve both their contributors and their communities.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like