PEO Deconstruction: Are You Paying for a Model That No Longer Fits?

Originally published on November 25, 2025

The Cost Spike and PEO Deconstruction SMB Leaders Can’t Ignore

PEOs were built for simplicity. But in 2026, simplicity is becoming a very expensive illusion.

For years, small businesses turned to PEOs to get payroll, benefits and compliance off their plate. When teams were small, time was tight and HR expertise didn’t exist, the PEO shortcut worked.

But the business environment has changed, and many PEOs haven’t kept up.

This shift has pushed many leaders into their own version of PEO deconstruction: breaking down costs, examining where flexibility has disappeared and asking whether the model still fits their stage of growth.

This is no longer a budgeting issue. For many organizations, it’s become a full PEO deconstruction, taking a closer look at what the model provides and what it now costs. Now, it’s a strategy issue.

Renewal increases across 2025 and 2026 are exposing what SMB leaders have quietly felt for years.

Some PEOs provide limited visibility into how administrative fees and pooled premiums are structured, making it difficult for employers to evaluate true cost.

The model that once felt practical now feels rigid, outdated and misaligned with how modern organizations grow.

SHRM forecasts healthcare cost increases of 10 percent over the next two years. PEO clients feel those increases immediately because pooled plans leave almost no room to negotiate.

When your renewal hits, the number is the number. No leverage, insight or strategic conversation.

The question is no longer “Is my PEO doing its job?”

The real question is “Is it keeping pace with my size, complexity and growth?”

When a PEO Still Makes Sense, and When It Stops Adding Value

PEOs deliver real value for early-stage businesses. When you have no HR staff, no compliance systems and no time, a bundled model gives you structure at the moment you need it most.

The model works best when simplicity outweighs the need for customization. PEOs also remain strong partners for organizations with high regulatory exposure, such as those operating across multiple states without dedicated HR.

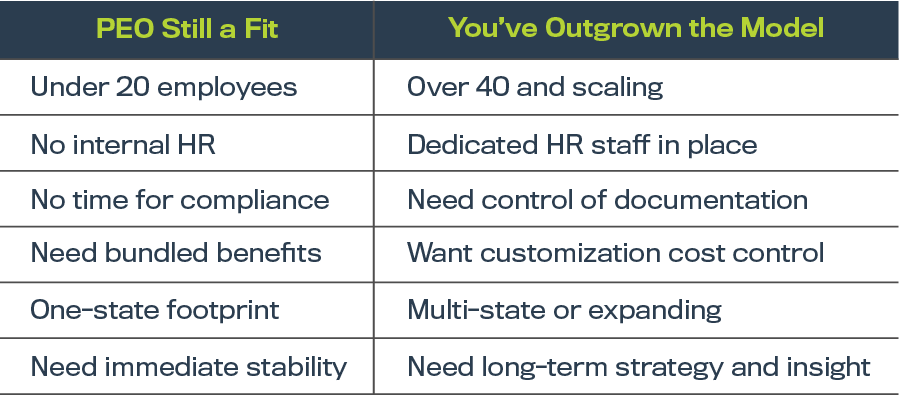

A PEO may still be the right fit if:

- Has fewer than 20 employees

- Relies on mostly W-2 roles

- Lacks internal HR expertise

- Needs access to competitive benefits you can’t get alone

- Operates in high-risk or highly regulated sectors

- Needs short-term stability after compliance issues

But the model isn’t built to scale with you.

Organizations outgrow their PEO when they:

- Cross 40 employees and start adding headcount

- Want control over their health carrier, broker or payroll system

- Can’t get a straight breakdown of administrative fees

- Hire an HR manager who can’t drive strategy under PEO constraints

- Plan new states, acquisitions or expanded operations

- See renewal increases outpacing any improvement in benefits

This is not about good or bad performance. It’s about fit.

Here is how that inflection point looks in practice:

If the right-hand column feels familiar, your PEO isn’t supporting your growth anymore. It’s slowing it down.

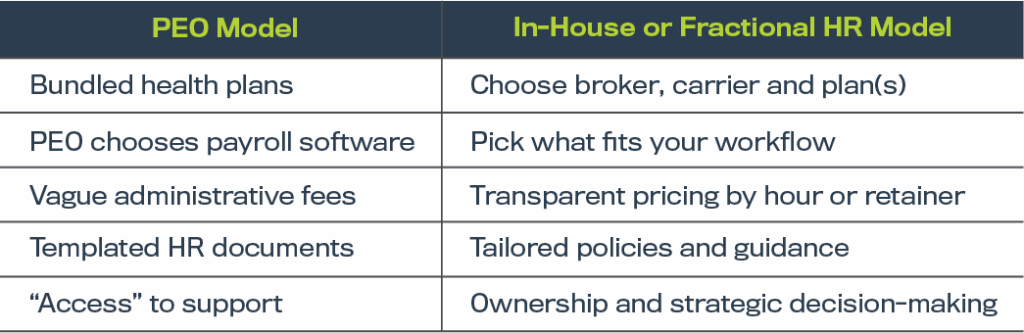

PEO vs In-House HR: A Question of Control

PEOs promise simplicity. But simplicity has limits. This is where real PEO deconstruction begins; understanding what you gain and what you give up.

The co-employment structure hands over control of key employer functions. You trade customization for convenience. As you grow, that trade-off becomes more restrictive than helpful.

This is the core of the PEO deconstruction conversation. If you can’t see what you’re paying for, you can’t manage it. And if you can’t manage it, you can’t optimize it.

Consider common limitations leaders run into:

- Waiting on PEO timelines to update policies

- Paying extra to roll out mid-year benefit changes

- Being blocked from exploring self-funded or alternate plan designs

- Getting templated HR guidance that doesn’t fit their organization

Fractional HR solutions or in-house HR systems give organizations what PEOs can’t: ownership. You control your compliance, your data, your documentation and your decisions.

James Moore’s HR compliance consulting often becomes the bridge. Leaders get clarity, structure and strategic support without giving up control.

Certified PEOs are reviewed by the IRS for financial responsibility, but they’re not required to disclose administrative markups. That gap is one of the biggest reasons growing organizations start looking elsewhere.

When It’s Time to Leave: The PEO Exit Signals Most Leaders Miss

Most organizations don’t evaluate their PEO until renewal season. By then, meaningful PEO deconstruction is overdue, options are limited and increases are locked in.

The warning signs show up months earlier:

- A new HR or operations leader feels boxed in

- Premiums rise with no explanation

- Compliance needs outpace the PEO’s capacity

- Leadership can’t access real-time HR data

- Fees can’t be cleanly itemized

A strategic exit is not abrupt. It’s phased, structured and low risk.

It starts with a PEO cost analysis and a plan to take back ownership of:

- Payroll

- Benefits administration

- Compliance documentation

- HRIS and employee data

- State registrations and tax IDs

A strong transition partner ensures the handoff is clean. That includes coordinating with your broker, managing liabilities like SUTA or COBRA and avoiding service gaps for employees.

Many companies see morale increase during a transition. Employees finally see transparency, flexibility and the organization investing in a better system.

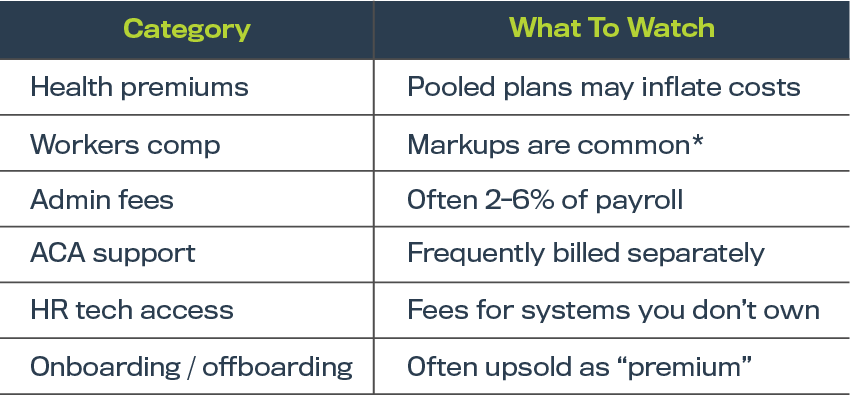

PEO Cost Analysis 2026: What Are You Really Paying For?

Here’s the reality: most CFOs don’t know their true PEO cost until someone breaks down the invoice line by line.

PEO bundles often hide pricing across several categories:

*Florida workers’ compensation rates have been reduced for eight years in a row, with a ninth decrease proposed. If that line item in your PEO package is going up, that’s a major red flag. It means you’re paying more in a category that should be costing you less, and it’s time to ask why.

And this is where the real surprise hits. When organizations compare PEO pricing to market averages, they often discover significant gaps.

Third-party analyses and employer case studies often show that PEO bundles can cost more than assembling services independently, particularly in years with high benefit increases.

In many client transitions we’ve supported, organizations discovered that assembling their own payroll, benefits and HR systems produced clearer pricing and, in some cases, lower overall cost than their previous PEO bundle.

This pattern is consistent across studies, industry benchmarks and client transitions.

If fees are difficult to locate, there’s usually a reason.

HR Outsourcing Alternatives That Work in 2026

PEO or nothing is a false choice. Growing organizations have three viable paths.

Fractional HR Solutions

Strategic HR support without the full-time cost.

A fractional HR partner can:

- Build compliance systems

- Coach internal HR or admin staff

- Lead hiring and employee relations

- Guide culture and organizational strategy

You pay for expertise, not overhead.

Hybrid HR Model

Your internal team runs operations, and an external advisor brings strategy.

Best for organizations where:

- Admin or HR coordinators need senior oversight

- New HR hires need development

- Companies are rolling out engagement or compensation programs

This model gives leaders confidence and teams clarity.

Standalone HR + Payroll Vendors

Keep automation. Drop the co-employment model.

Typical setup:

- Payroll through Gusto, ADP, Paylocity or Rippling

- HRIS for PTO, documentation and performance

- Direct broker relationship on your terms

- On-demand HR support as needed

You gain flexibility without sacrificing efficiency.

Renewal Season Is Coming. Your Strategy Needs to Be Ready.

The workforce has changed. Costs have changed. Expectations have changed. PEOs aren’t built for the level of flexibility SMBs now need.

These insights are based on national employer surveys, industry research and James Moore HR Solutions’ experience supporting PEO transitions across multiple industries.

Don’t let renewal numbers make the decision for you. Evaluate your options before the contract locks you in for another year.

James Moore HR Solutions helps organizations take control of their HR strategy through fractional HR support, hybrid HR models and compliant PEO transition services. We help you compare true costs, navigate transitions and build systems that scale with your team.

If your renewal is approaching, now is the right moment to reassess.

Take control of your HR strategy before 2026 increases hit. Let’s take the next step together.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

FAQs

Other Posts You Might Like